Financial Planning

Could a life changing event when eight-year-old Janine McLean’s farming father passed away have subconsciously set her on a path decades later to specialise in succession planning? Whatever her reasons, Janine loves living and working in regional Victoria and is a strong advocate for family run businesses to better plan for their future.

Listen to my online chat with Janine here or keep on reading the article below.

‘Even with my father dying I have such fond childhood memories of growing up on the farm with four brothers,’ Janine remembers. ‘I always talk about Patchewollock with passion and my biggest learning was that we all need to be able to adapt and change.’

After Janine completed Year 12 at Hopetoun Secondary College, she left the farm in the steady hands of her mother and two of her brothers, moving to Mildura as the first step in finding her own future.

‘I had absolutely no idea what I wanted to do,’ Janine admits, but she decided to enrol in a hospitality course at TAFE in Mildura. It makes perfect sense when she goes on to talk about her time living and working in Ireland and Canada, but ironically, not once did she work in hospitality.

Instead she was employed in an administration role with Guinness (owned by Diageo) in Dublin, Ireland. Taking on additional studies she later found herself in a para planning role for a firm in Calgary, Canada. It just kept snowballing from there. Moving back to Mildura her work history resulted in her being contracted by two experienced financial advisers working under The Farm Protectors brand across the region

‘I worked in para planning for several years and have now progressed into an advisory role,’ Janine explains. ‘Stephen and Gary have been in the business a long time, so I am part of their succession plan. They are wonderful mentors. There’s lots you can’t learn from books; it has to come from the trenches.’

With all the Royal Commission upheaval of the past year I am interested how Janine and her colleagues protect their customers and themselves in the role of a financial adviser.

‘Our licensing and compliance are all taken care of by a Dealer Group in Melbourne,’ Janine explains. ‘We have professional development three times a year to make sure we are kept up to date and that inhouse systems are meeting regulations.’

I file this snippet of information away. This seems like a great arrangement for smaller firms working out in the region and I think it could apply to quite a few different professions. We all hate spending time in the office and reading through heaps of often irrelevant documents just in case there is something we need to know.

From having interviewed many family run businesses I already know that doing financial and succession planning with the support of independent advisers is a smart thing to do (READ Tom Smith’s thoughts on succession planning). Regardless, I ask Janine to clarify why it is important.

‘Families put their life blood, sweat and tears into their business. In many respects it is their superannuation plan. They either rely on the sale of the business or transition to the next generation to produce income for them to retire on.’

Sadly, not everything always goes to plan as we know it is a rapidly changing environment.

‘Businesses need to start planning early and keep revisiting those plans,’ Janine cautions. ‘Government pensions are not going to be around forever. The kids also need to be brought into the conversation, so we know what they are thinking.’

Putting off hard decisions is not a smart move according to Janine.

‘The earlier we start the easier it is to find a solution that meets everybody’s needs. We just need to take stock of where we are at now and where we want to go. It is a team effort also involving their accountant and solicitor with different parts of the planning.’

Having grown up in a rural community, Janine is well attuned to what happens when there isn’t good planning in place.

‘Money can be a taboo subject and some aspects uncomfortable to talk about, but those who don’t have any kind of plan in place are at risk.’

Janine goes on to explain that these risks vary depending on the complexity of the situation, the size of business involved and when and how the succession planning event occurs.

‘The worst-case scenarios are always either having to exit the farm because they can no longer meet repayment obligations or are at risk of being sold up by the banks. While obviously these risks are far greater for the families involved, it also has a heavy impact on the whole community, especially where that community is close knit.’

At the other end of the spectrum; and still far from ideal, Janine says that lack of planning can result in little to no ongoing income to allow the retiring generation to enjoy their retirement lifestyle that they worked so hard for.

In addition to regularly travelling home to see family and support the Ouyen United Football & Netball Club, Janine mentions during our chat how much she loves visiting clients out in the region. I now have a sense of why. Every rural business deserves an opportunity to plan and be able to adapt and change, particularly in these interesting times.

DISCLAIMER: Kerry Anderson has not had any commercial dealings with Janine McLean or The Farm Protectors and does not endorse their products in any way. As always, this is simply an opportunity to share an authentic story that will hopefully provide some useful information for rural businesses and communities. Your decisions remain your own.

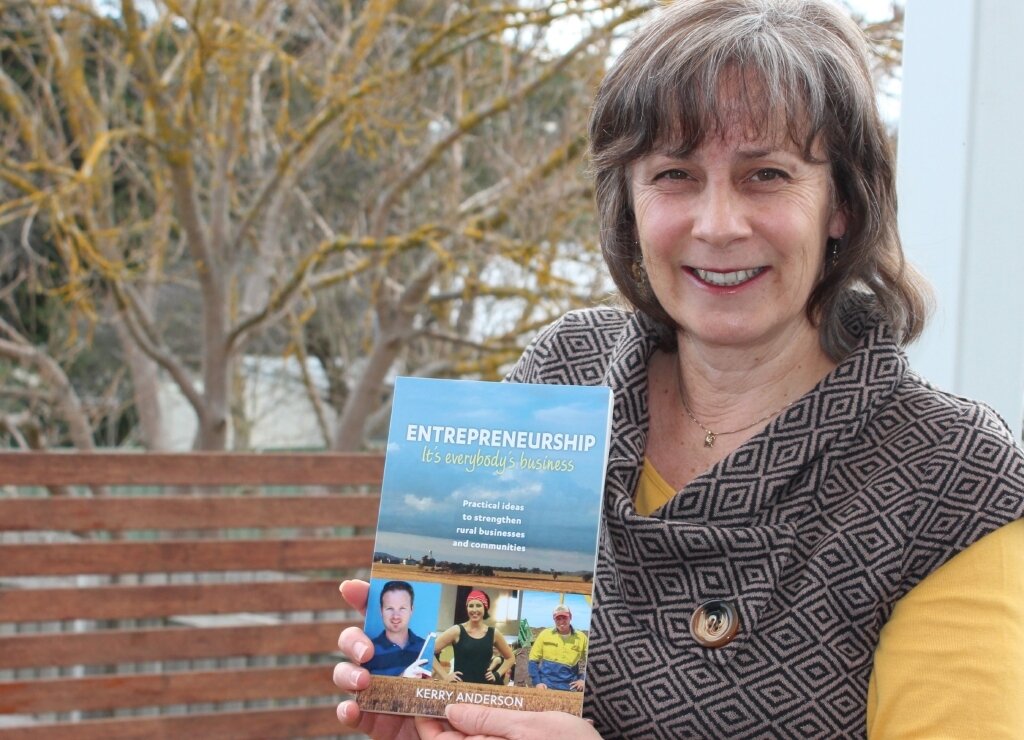

KERRY ANDERSON: Founder of the Operation Next Gen program and author of ‘Entrepreneurship: It’s Everybody’s Business,’ Kerry works with small businesses and rural communities to help them embrace new opportunities. In 2018 she was named as one of Australia’s Top 50 Regional Agents of Change. READ MORE